The Ministry of Energy and Mineral Resources confirmed the results of an oil and gas block auction held since 2017 will be announced at the end of January 2018.

In addition, the management decision of four oil and gas blocks that are under contract by PT Pertamina will be decided in the near future. Pertamina, as a national oil and gas company, has the right to match to immediately take over the oil and gas working area that has been exhausted.

Archandra Tahar

Deputy Minister of Energy and Mineral Resources (ESDM) Archandra Tahar said the auction results of the oil and gas block will be announced earlier than the previous plan, ie at the end of January 2018. Previously, the Ministry of Energy and Mineral Resources auction results announced in early February 2018.

"We are accelerating for the exploration process can also be faster for the 'winners of the auction," he said on Monday (22/1).

Archandra was reluctant to ensure the winners of the auction that there is only one enthusiast.

"Later the certainty, wait for the results out," he said.

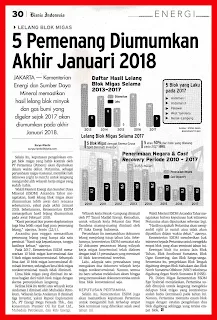

In 2017, the ESDM Ministry offers 10 conventional oil and gas blocks and 5 unconventional oil and gas blocks. A total of five out of 10 conventional oil and gas blocks are attractive to investors while five non-conventional oil and gas blocks are still unattractive. The five oil and gas blocks are all part of seven oil and gas blocks with direct appointment schemes.

The five blocks consist of the Andaman I work area in demand by Mubadala Petroleum. The Andaman II working area attracted three investors, Repsol Exploracion SA, PT Energi Mega Persada Tbk, and Premier Oil Far East Ltd. consortium, Mubadala Petroleum. and Kris Energy.

Merak-Lampung working area is interested by PT Tansri Madjid Energi. Then, for the work area, Pekawai and West Yamdena respectively enthused by PT Saka Energy Indonesia. The company filed for auction documents last year.

Previously, the ESDM ministry noted that there were 20 tender documents for the auction of conventional oil and gas working areas being accessed with a total of 13 companies interested in the 10 conventional blocks. then, there is also one company that accesses two documents of unconventional oil and gas working area. However, all that is limited to access to the only documents that remain for five conventional blocks only.

DECREE OF PERTAMINA

In addition, the ESDM Ministry will also confirm Pertamina's decision to take the right to four termination blocks granted since the beginning of this year. Deputy Minister of EMR Arcandra Tahar said that Pertamina's privilege decision will be decided shortly.

"The result is whether Pertamina will take the right to match or will not be confirmed in the near future," he said.

The Ministry of Energy and Mineral Resources grants Pertamina privileges to manage four blocks to be terminated this year. The four blocks are Tuban Block, Southeast Sumatra Block, Ogan Komering Block and Sanga-Sanga Block. Meanwhile, the management of the Central Block is combined with the Mahakam Block and the Offshore North Sumatera Block (NSO) technically combined with North Sumatra B (NSB).

Ego Syahrial

Implementing the task of the Director General of Oil and Gas at the Ministry of Energy and Mineral Resources Ego Syahrial explained that Pertamina has been appointed to directly manage eight oil and gas blocks whose contract has expired (termination) this year. However, Pertamina requested six oil and gas blocks with two block management records combined so that the remaining four blocks.

IN INDONESIA

5 Pemenang Diumumkan Akhir Januari 2018

Kementerian Energi dan Sumber Daya Mineral memastikan hasil lelang blok minyak dan gas bumi yang digelar sejak 2017 akan diumumkan pada akhir Januari 2018.

Selain itu, keputusan pengelolaan empat blok migas yang habis kontrak oleh PT Pertamina akan diputuskan dalam waktu dekat. Pertamina, sebagai perusahaan migas nasional, memiliki hak istimewa (right to match) untuk langsung mengambil alih wilayah kerja migas yang sudah habis.

Wakil Menteri Energi dan Sumber Daya Mineral (ESDM) Arcandra Tahar mengatakan, hasil lelang blok migas akan diumumkan lebih awal dari rencana sebelumnya, yakni pada akhir Januari 2018. Sebelumnya, Kementerian ESDM menargetkan hasil lelang diumumkan pada awal Februari 2018.

"Kami percepat agar proses eksplorasinya juga bisa lebih cepat bagi para ‘pemenang lelang,” ujamya, Senin (22/1).

Arcandra pun enggan memastikan pemenang lelang yang hanya ada satu peminat.

“Nanti saja kepastiannya, tunggu hasilnya keluar,” ujarnya.

Pada 2017, Kementerian ESDM menawarkan 10 blok migas konvensional dan 5 blok migas nonkonvensional. Sebanyak lima dari 10 blok migas konvensional diminati investor sedangkan lima blok migas nonkonvensional masih tidak diminati. Lima blok migas yang diminati itu semua bagian dari tujuh blok migas dengan skema penunjukkan langsung.

Kelima blok itu terdiri atas wilayah kerja Andaman I diminati oleh Mubadala Petroleum. Wilayah kerja Andaman II diminati tiga investor, yakni Repsol Exploracion SA, PT Energi Mega Persada Tbk., dan konsorsium Premier Oil Far East Ltd., Mubadala Petroleum. dan Kris Energi.

Wilayah kerja Merak-Lampung diminati oleh PT Tansri Madjid Energi. Kemudian, untuk wilayah kerja Pekawai dan West Yamdena masing-masing diminati oleh PT Saka Energi Indonesia. Perusahaan itu memasukkan dokumen lelang menjelang tutup tahun lalu.

Sebelumnya, kementerian ESDM mencatat ada 20 dokumen penawaran lelang wilayah kerja migas konvensioal telah diakses dengan total 13 perusahaan yang meminati 10 blok konvensional tersebut. lalu, ada pula satu perusahaan yang mengakses dua dokumen wilayah kerja migas nonkonvensional. Namun, semua itu baru sebatas melakukan akses hingga yang memasukkan dokumen tersisa untuk lima blok konvensional saja.

KEPUTUSAN PERTAMINA

Selain itu, Kementerian ESDM juga akan memastikan keputusan Pertamina untuk mengambil hak terhadap empat blok terminasi yang diberikan sejak awal tahun ini. Wakil Menteri ESDM Arcandra Tahar mengatakan bahwa keputusan hak istimewa Pertamina akan diputuskan sebentar lagi.

“Hasilnya apakah Pertamina akan mengambil right to match atau tidak akan dipastikan dalam waktu dekat,” ujarnya.

Kementerian ESDM memberikan hak istimewa kepada Pertamina untuk mengelola empat blok yang akan terminasi tahun ini. Keempat blok itu antara lain Blok Tuban, Blok Southeast Sumatera, Blok Ogan Komering, dan Blok Sanga-sanga. Sementara itu, pengelolaan Blok Tengah digabung dengan Blok Mahakam dan Blok North Sumatera Offshore (NSO) teknisnya digabung degan North Sumatera B (NSB).

Pelaksana tugas Dirjen Migas Kementerian ESDM Ego Syahrial menjelaskan, Pertamina sudah ditunjuk untuk langsung mengelola delapan blok migas yang kontraknya sudah habis (terminasi) pada tahun ini. Namun, Pertamina meminta enam blok migas dengan catatan pengelolaan dua blok digabung sehingga yang tersisa empat blok.

Bisnis Indonesia, Page-30, Tuesday, Jan 23, 2018