President Joko Widodo (Jokowi) warned the ministers of the Cabinet of Work to issue a Ministerial Regulation referring to concrete measures that make it easy for businesses to invest and expand business.

In addition to reprimanding Minister of Environment and Forestry Siti Nurbaya, President Jokowi also reprimanded the Vice Minister of Energy and Mineral Resources (ESDM) Arcandra Tahar. Both ministries are still considered to implement policies that are not business and investment.

"You see, every Ministerial Regulation and our policy will be evaluated, whose purpose is to facilitate investment. That's a message from the President. And that we really pay attention, "said Arcandra at the State Palace, Jakarta, Monday (24/7).

He said the evaluation will also be conducted on 43 Ministerial Regulations issued this year to be more probable and can help business actors to have a broader perspective. It is ready to improve if there is a weakness in the 43 Ministerial Regulation.

"This is the President's message to Ministerial Regulation. Not a Ministerial Regulation, Ministerial Regulation to be noticed this Ministerial Regulation can accelerate the growth of investment in Indonesia. This year there are 42 or 43 Ministerial Regulations, all of which we will evaluate "said Arcandra without mentioning the Minister Regulation.

An energy observer from Trisakti University, Pri Agung Rakhmanto, said that the recently issued ESDM Ministerial Regulation does indeed hamper investment. He mentioned the regulations ranging from the implementation of gross split schemes for the oil and gas sector, then renewable energy renewable energy regulations, gas prices, until the Minister of Energy and Mineral Resources Regulation No 42/2017

"The government is a good facilitator for investment because in many ways in the energy sector, the government does not invest alone," he said.

According to Pri Agung, the evaluation to be conducted by the ESDM Ministry should involve stakeholders.

"The government must be willing to listen, correct the mistake if it exists. Can not feel the most right, "he said.

Meanwhile, Vice Chairman of the Association of Minerals Processing and Refining Company of Indonesia (AP3I) Jonatan Handoyo said, it never conveyed to the Ministry of Energy and Mineral Resources Regulation No. 6 of 2017 which interfere with the investment climate. The reason is that the rule relaxes the exports of low grade nickel ore since January 11, 2017 to five years into the future.

The policy puts the nickel price down drastically from US $ 11,000 per ton last year to around US $ 8,000-9,000 per tonne today. Consequently a total of 17 nickel smelters ceased operations in the second half of 2017.

This is because the production cost of US $ 10,000 per ton is higher than the nickel price, causing the smelter to suffer losses. It's just that Vice Minister of EMR Arcandra Tahar who at that time met the association did not react. His side then met the Head of Indonesian Investment Coordinating Board Thomas Lembong in early July yesterday.

The management of AP3I conveyed the same problem. This time Thomas Lembong responded to the complaint and asked for a letter addressed to President Joko Widodo. Jonatan hoped that the President's reprimand could bring fresh air into the nickel investment climate.

"Instruction like this has been done in Limited Cabinet Meeting) March 22 last, But no reaction," said Jonatan

For example, according to data from the Special Unit for Upstream Oil and Gas Business Activities (SKK Migas), upstream oil and natural gas investments continue to fall each year. SKK Migas recorded the realization of upstream oil and gas investment in the first half of this year only US $ 3.98 billion, down from the same period last year of US $ 5.65 billion.

Head of SKK Migas Amien Sunaryadi previously said that upstream oil and gas investment this year is targeted to reach US $ 13.8 billion. However, the realization of investment until June was only US $ 3.98 billion or 28% of the target. This realization is admittedly not in accordance with the expected side.

"In fact, upstream oil and gas investment is important for the country, because it has a significant trickle down effect. Because if the upstream oil and gas investment is small, then spending to supporting industries is also small, "he said.

He said, many things that cause low realization of this upstream oil and gas investment. One reason is the price of crude oil that has not changed much. With current oil prices, oil and gas investors are said to be hesitant to invest in exploration activities.

In fact, if there is no discovery of oil and gas reserves, investors will also not be sure in spending funds for development. As regards the issuance of several new regulations in recent times, Amien has dismissed this pressure on oil and gas investment. Regulations affecting current oil and gas investments are greater due to long-standing regulations, one of which is Government Regulation No. 79 of 2010 which regulates the cost recovery and taxation of upstream oil and gas business.

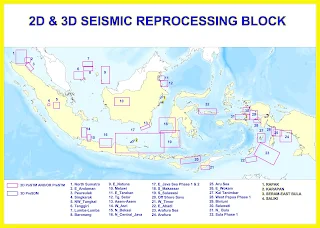

These factors determine the economic calculations of oil and gas projects. So there are some delayed or even delayed oil and gas projects. This is reflected from the data of survey and drilling activities held by SKK Migas. Until last June, the new 2D seismic survey activity was 3,432 kilometers (km) or 12% of the target of 10,248 km, 3D seismic survey 330 kilometers Square or 13% of the target of 6,566 square kilometers, exploration drilling 29 wells of 138 well targets, well drilling of 74 wells from 223 wells, and realization of new well work work of 351 activities from target

907 activities.

However, Amien hopes oil and gas investment will improve in the second half following the issuance of Government Regulation 27/2017 which is a revision of the Government Regulation 79/2010.

"This is out of Government Regulation 27/2017 hopefully can encourage the growth of upstream oil and gas investment," he said.

IN INDONESIA

Jokowi Minta ESDM Evaluasi Peraturan Menteri

Presiden Joko Widodo (Jokowi) memperingatkan jajaran menteri Kabinet Kerja untuk mengeluarkan Peraturan Menteri yang mengacu pada Iangkah-Iangkah Konkret yang memberikan kemudahan bagi kalangan dunia usaha untuk berinvestasi dan berekspansi bisnis.

Selain menegur Menteri Lingkungan Hidup dan Kehutanan Siti Nurbaya, Presiden Jokowi juga menegur Wakil Menteri Energi dan Sumber Daya Mineral (ESDM) Arcandra Tahar. Kedua kementerian itu dinilai masih menerapkan kebijakan yang tidak probisnis dan investasi.

“Begini, setiap Peraturan Menteri dan kebijakan akan kami evaluasi, yang tujuannya untuk mempermudah investasi. Itu pesan dari Presiden. Dan itu sangat kami perhatikan,” kata Arcandra di Istana Negara, Jakarta, Senin (24/7).

Dia mengatakan, evaluasi juga akan dilakukan atas 43 Peraturan Menteri yang diterbitkan tahun ini agar makin probisnis serta dapat membantu para pelaku usaha agar memiliki persepektif yang lebih luas. Pihaknya siap memperbaiki jika memang ada kelemahan dalam 43 Peraturan Menteri itu.

“Ini pesan Presiden untuk Peraturan Menteri. Bukan satu Peraturan Menteri, Peraturan Menteri agar diperhatikan Peraturan Menteri tersebut bisa mempercepat tumbuh kembangnya investasi di Indonesia. Tahun ini sudah ada 42 atau 43 Peraturan Menteri, semuanya akan kita evaluasi” ujar Arcandra tanpa menyebutkan Peraturan Menteri dimaksud.

Pengamat energi dari Universitas Trisakti Pri Agung Rakhmanto mengatakan, Peraturan Menteri ESDM yang diterbitkan belakangan ini memang menghambat investasi. Dia menyebut peraturan-peraturan itu mulai dari penerapan skema bagi hasil kotor (gross split) untuk sektor migas, kemudian peraturan listrik energi baru terbarukan, harga gas, hingga Peraturan Menteri ESDM No 42/2017

“Pemerintah jadilah fasilitator yang baik untuk investasi karena dalam banyak hal di sektor energi, pemerintah tidak berinvestasi sendiri,” tuturnya.

Menurut Pri Agung, evaluasi yang akan dilakukan Kementerian ESDM hendaknya melibatkan pemangku kepentingan.

“Pemerintah memang harus mau mendengar, mengoreksi kesalahan kalau memang ada. Tidak boleh merasa paling benar,” ujarnya.

Sementara itu, Wakil Ketua Asosiasi Perusahaan Pengolahan dan Pemurnian Mineral Indonesia (AP3I) Jonatan Handoyo menuturkan, pihaknya pernah menyampaikan kepada Kementerian ESDM terkait Peraturan Menteri No 6 Tahun 2017 yang mengganggu iklim investasi. Pasalnya aturan itu merelaksasi ekspor bijih nikel kadar rendah sejak 11 Januari 2017 hingga lima tahun ke depan.

Kebijakan itu membuat harga nikel turun drastis dari US$ 11.000 per ton pada tahun lalu menjadi sekitar US$ 8.000-9.000 per ton saat ini. Alhasil total sebanyak 17 smelter nikel berhenti operasi pada semester kedua 2017.

Hal itu disebabkan biaya produksi yang mencapai US$ 10.000 per ton lebih tinggi daripada harga nikel, membuat pelaku smelter merugi. Hanya saja Wakil Menteri ESDM Arcandra Tahar yang saat itu menemui asosiasi tidak bereaksi. Pihaknya kemudian menemui Kepala Badan Koordinasi Penanaman Modal Indonesia Thomas Lembong pada awal Juli kemarin.

Pengurus AP3I menyampaikan permasalahan yang sama. Kali ini Thomas Lembong merespon keluhan itu dan meminta dibuatkan surat yang ditujukan ke Presiden Joko Widodo. Jonatan berharap teguran yang disampaikan Presiden bisa membawa angin segar ke dalam iklim investasi nikel.

“Instruksi seperti ini sudah pernah dilakukan dalam Rapat Kabinet Terbatas) 22 Maret lalu, Tapi tidak ada reaksinya,” ujar Jonatan

Sebagai contohnya, menurut data Satuan Kerja Khusus Pelaksana Kegiatan Usaha Hulu Minyak dan Gas Bumi (SKK Migas), investasi sektor hulu minyak dan gas bumi nasional terus turun setiap tahunnya. SKK Migas mencatat realisasi investasi hulu migas semester pertama tahun ini hanya US$ 3,98 miliar, turun dari periode yang sama tahun lalu sebesar US$ 5,65 miliar.

Kepala SKK Migas Amien Sunaryadi sebelumnya mengatakan, investasi hulu migas pada tahun ini ditargetkan mencapai US$ 13,8 miliar. Namun, realisasi investasi hingga Juni lalu hanya sebesar US$ 3,98 miliar atau 28% dari target. Realisasi ini diakuinya memang tidak sesuai dengan yang diharapkan pihaknya.

“Padahal investasi hulu migas penting buat negara, karena punya trickle down effect yang signifikan. Karena kalau investasi hulu migas kecil, maka belanja ke industri pendukung juga kecil,” ujarnya.

Dikatakannya, banyak hal yang menjadi penyebab rendahnya realisasi investasi hulu migas ini. Salah satu penyebabnya yakni harga minyak mentah yang belum banyak berubah. Dengan harga minyak saat ini, investor migas disebutnya ragu-ragu untuk investasi di kegiatan eksplorasi.

Padahal, jika tidak ada penemuan cadangan migas, investor juga tidak akan yakin dalam mengeluarkan dana untuk pengembangan. Soal terbitnya beberapa peraturan baru beberapa waktu terakhir, Amien menampik hal ini menekan investasi migas. Regulasi yang berdampak pada investasi migas saat ini lebih besar disebabkan oleh regulasi-regulasi yang telah terbit sejak lama, salah satunya Peraturan Pemerintah No 79 Tahun 2010 yang mengatur soal cost recovery dan perpajakan dalam usaha hulu migas.

Berbagai hal ini menentukan kalkulasi keekonomian proyek migas. Sehingga ada beberapa proyek migas yang tertunda atau malah belum dilaksanakan. Hal ini tergambar dari data pelaksanaan kegiatan survei dan pengeboran yang dimiliki SKK Migas.

Sampai Juni lalu, kegiatan survei seismik 2D baru sepanjang 3.432 kilometer (km) atau 12% dari target 10.248 km, survei seismik 3D 330 kilometer persegi atau 13% dari target 6.566 kilometer persegi, pengeboran eksplorasi 29 sumur dari target 138 sumur, pengeboran sumur pengembangan 74 sumur dari target 223 sumur, dan realisasi kegiatan kerja ulang (workover) sumur baru 351 kegiatan dari target

907 kegiatan.

Meski demikian, Amien berharap investasi migas bakal membaik di semester kedua ini menyusul diterbitkannya Peraturan Pemerintah 27/2017 yang merupakan revisi dari PP 79/2010.

“Ini sudah keluar Peraturan Pemerintah 27/2017 semoga dapat mendorong menumbuhkan investasi hulu migas,” ujarnya.

Investor Daily, Page-9, Tuesday, July 25, 2017