Fluctuations in world crude oil prices have not disrupted the performance of PT Pertamina's business. Pertamina's ongoing oil and gas projects are still safe However, the oil price fluctuation to above US $ 50 per barrel should be wary because it could undermine Pertamina's investment capability and narrow the fiscal space of APBN-P 2017.

Lately there have been fears of crude oil prices back in turmoil after the Organization of the Petroleum Exporting Countries (OPEC), Russia and several other major producers cut production by about 1.8 million barrels per day since early 2017. The condition helped trigger an increase in oil prices by 15 % in the last month. Another trigger is reduced utilization United States oil fields (USA). The price of light sweet crude for November delivery was at US $ 52.07 per barrel, while Brent crude oil in the range of US $ 58.19 per barrel.

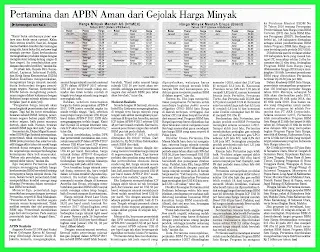

In APBN-P 2017, the assumption of national crude price (ICP) is set at US $ 48 per barrel. Based on data from the Ministry of Energy and Mineral Resources (ESDM), ICP average during January to August 2017 reached US $ 48.41 per barrel. Pertamina's Finance Director Arief Budiman revealed that the relatively safe crude oil price for Pertamina is at US $ 45-50 per barrel.

"You see, the volume balance is still much downstream compared to upstream oil and gas. Not to mention the price of fuel oil (BBM) retail is still following the government's decree price, "said Arief.

Asked about the possibility of Pertamina's financial condition if the oil price jumped above US $ 50 per barrel in the long term, Arief Budiman replied diplomatically, "If above that, his name can be relative yes. If on going operations, of course, may still be able to achieve profit, but will undermine the ability of investment. "

Arief explained that Pertamina booked 19 percent revenue, higher in the first half of 2017 compared to the same period last year, reaching US $ 20.5 billion. However, due to eroded crude oil prices continue to rise, while fuel prices are held steady, Pertamina's profit fell 24% to US $ 1.4 billion. Arief did not specify the impact of world oil price hike on Pertamina's investment.

"We have to calculate how high the oil price is," he said.

Nevertheless, according to Arief Budiman, Pertamina is ready if the price of crude oil continues to strengthen.

"We already have the scenario. There are several steps that can be done. The point is still many ways and solutions, such as inviting partners, "he said.

Separately, Director of Investment Planning and Risk Management Pertamina Gigih Prakoso admitted, in terms of finance, Pertamina has many limitations. On the one hand, Pertamina should consider dividends for the government. On the other hand, the BUMN must be able to maintain its financial capability. That is why, Pertamina is now a lot of cooperation cooperation with partners

strategic.

"We open the joint venture or joint operation. If it was all alone. Nowadays, taking into account the conditions and challenges that exist, we welcome the welcome for strategic partners. We are committed to increase oil and gas production by acquiring oil and gas fields overseas. It requires funding and credible partners, "he said.

On the other hand, Head of Bureau of Communications, Public Information Service and Cooperation of Ministry of Energy and Mineral Resources, Dadan Kusdiana, stated that the strengthening of world crude oil price correlated with state revenue. However, the ESDM Ministry has not calculated the state revenue in relation to oil price fluctuations during the year (year to date / ytd).

"The strengthening of oil prices will boost revenues from the oil and gas sector. But it also helped to increase the amount of fuel subsidy. In essence, the non-tax state revenue (PNBP) of the oil and gas sector, both central and regional, will rise. However, the amount of fuel subsidy also went up, "he said.

Meanwhile, Director General of Oil and Gas Ministry of ESDM Ego Syahrial asserted, the government did not raise the price of premium fuel and diesel fuel until the end of this year despite the world oil price strengthened. The decision fully considers the purchasing power of the people.

"There has been no change, still remain until the end of the year," he said.

Ego believes Pertamina is still able to bear the difference in the price of subsidized fuel economy as the world oil price increases. However, it does not mean the government does not care about the condition of losers faced by Pertamina in distributing subsidized fuel. According to Ego, the government is also thinking about the development of Pertamina's investment, such as in the Mahakam Block.

"The government must look at everything comprehensively. Do not see anything from the marketing side of BBM alone. The government also thinks of the corporate side. In time the government also does not remain silent, "he asserted.

APBN Realistic

Member of Commission XI of the House of Representatives, Karya M Sarmuji, said the assumption of national crude oil price (ICP) in APBN-P 2017 of US $ 48 per barrel is still sufficient and not too low when the oil price trend is gradually rising. In fact, before fixing the price in the approval of APBN-P 2017, the House of Representatives actually assess the figure is still too high.

"So, before approving the oil price of US $ 48 per barrel in APBN-P 2017, the House once considered it too high. We of Commission XI had worried about the average ICP will move below that, "he said.

Sarmuji explained that when the DPR and the government discuss and approve the ICP assumption in APBN-P 2017 of US $ 48 per barrel, ICP during the first half of 2017 is still at the level of US $ 43 per barrel. Then, the price of oil in the APBN-P is agreed at US $ 48 per barrel considering the oil price usually tends to rise by the end of the year.

The trend of rising world crude oil prices will occur in the last 1-2 months (August-September). It's linked to the winter cycle in the US and Europe, requiring more fuel supply to keep the air warm both at home and office.

Brent North Sea oil price on September 26 reached US $ 58.01 per barrel for November 2017 contract compared to the beginning of January around-US $ 56.82 per barrel. Meanwhile, light sweet crude prices in the Nymex market on September 26 reached US $ 52.00 per barrel compared to the beginning of January at US $ 52, 33 per barrel. With these assumptions, Sarmuji believes that oil and gas revenues in APBN-P 2017 and fuel subsidies are relatively unchanged.

"We believe the assumption of US $ 50 per barrel oil price will be met, so the assumption of state revenues and fuel subsidies will not change," he said.

Moderate-Realistic

In line with M Sarmuji, economist Indef Eko Listiyanto revealed, in the current trend of rising oil prices due to increased demand in Europe and America, ICP assumption in APBN-P 2017 of US $ 48 per barrel is still realistic. Therefore,

assumptions on oil and gas revenues and fuel subsidies need not be changed. In APBN-P 2017, the subsidy is set at Rp 168.87 trillion. Of that amount, Rp 50.2 trillion is allocated for fuel and LPG.

"The winter factors are fueling the rise in oil prices in Western countries. But due to the abundant supply and supply and world economic growth tends to be flat, the average oil price this year will not rise significantly. So, the assumption of oil price of US $ 48 per barrel in APBN-P 2017 is still moderet and realistic, "he said.

Eko Listiyanto estimates ICP until the end of this year does not move far from the current range of US $ 50 per barrel, although Brent crude oil is approaching the level of US $ 60 per barrel.

"That is assuming the absence of geopolitical turmoil, both in the Middle East as a major supplier of world oil and supply disruption due to turmoil in other regions," he said.

According to him, the government and parliament's decision to increase ICP's assumption in APBN-2017 to US $ 48 per barrel from the assumption of State Budget of US $ 45 per barrel will also not significantly affect Pertamina's business.

"Pertamina can still record profits not far as projected, although it must import more crude oil 50% of its product capability to ensure domestic fuel supply," he said.

Therefore, Eko also estimates that Pertamina's expenditure to finance the public service obligation (PSO) of BBM Satu Price in the foremost, lagging, and outermost areas (3T) will not change much from the initial assumption. The BBM Satu Price program should still be implemented and maintained to ensure justice for people to get the same fuel prices as in Java.

Pertamina President Director Elia Massa Manik recently said that the average price of crude oil during the first half of 2017 compared to the same period last year rose 30% from US $ 36.16 per barrel to US $ 48.9 per barrel. However, the price of subsidized fuel and assignment are retained. In fact, Elijah said, the current price of fuel is formed with benchmark crude oil prices far below current prices.

"Not only that, the realization of investment disbursed by Pertamina also increased from US $ 810 million to US $ 1.49 billion," he said.

Pertamina Finance Director Arief Budiman some time ago explained that the company's revenue was driven by the increase in fuel consumption of non-subsidized fuel price increase. As a result, in terms of cash flow, Pertamina's finances improved.

"The position in the first quarter, operating cash flow is still negative, now it is positive. But still must be in-balance with the payment of short-term debt, so that the condition can now be maintained, even improved, "he said.

Pertamina data showed that Pertamina's fuel sales rose 4 percent in the first half of 2017 compared to the first half of 2016, from 31.47 million kl to 32.6 million kl. Premium consumption fell 34% from 5.78 million kl to 3.82 million kl, but Pertamite, Pertamax Turbo and First gasoline consumption rose 25.54% from 9.75 million kl to 12.24 kl. Consumption of subsidized diesel also rose from 6.51 million kl to 6.8 million ld and Dexlite diesel consumption increased from 80 thousand kl to 250 thousand kl.

Based on data from Pertamina, Pertamina's non-fuel product sales increased during the first half of 2017. Up to the end of last June, Pertamina posted sales of liquid gas / LPG of 6.23 million MT, up 6.3% from 5.86 million MT. Meanwhile, sales of petrochemical products rose from 1.31 million kl to 1.37 million kl.

Pertamina's upstream performance is also better. Oil and gas production until the end of June reached 692 thousand barrels of oil equivalent per day (bsmph), up 8% from the same period last year 640 thousand bsmph. Pertamina is targeting oil production of 334 thousand bpd and gas is slightly lower 1% of target, 2,080 mmscfd. However, this year's net profit projection is not projected as high as the current fuel price is set with ICP of US $ 30 per barrel or Brent crude price of US $ 40 per barrel. In fact, the current price of Brent crude oil already above US $ 50 per barrel.

Based on the company's budget plan, Pertamina's net profit in 2017 is targeted at US $ 3.04 billion, but its realization is estimated at only US $ 2.3 billion assuming that oil price is unchanged and efficiency is going on. Pertamina currently receives a mandate to impose a one price BBM Program. This program refers to the Minister of Energy and Mineral Resources Regulation No. 36 of 2016 on the Accelerated Enforcement of One Price of Specific Fuel (JBT) and Types of Special Fuel Assignment (JBKP).

Based on this beleid, 148 districts are designated as the location for the distribution of BBM in BBM One Price Program gradually in the period 2017-2020. In Indonesia there are currently around 160 districts / cities included in the 3T category covering about 2 thousand subdistricts and 21 thousand villages.

While the BBM One Price Program implemented until 2019 only reaches 150 points. Pertamina's investment of fuel needed is around Rp 2030 million per point. In the Roadmap of BBM Satu Price, the government targets the operation of 150 channeling institutions by 2019. In detail, 54 points will be completed by 2017, then 50 points in 2018 and 46 in 2019. Two business entities assigned to implement the program are Pertamina and PT AKR Corporindo.

During the first semester of 2017, Pertamina has realized the BBM One Price Program at 21 points from the 54 point target this year. A total of 21 points consists of eight points which are part of the Papua One Price Program, a point in Krayan, North Kalimantan, and 12 points from 54 points which became the target of the implementation of Indonesia One Price program this year.

The 12 tiliks are spread on Pulau Batu in North Sumatra, Central Siberut in West Sumatra, Karimun Islands in Central Java, Raas Island in East Java, Tanjung Pengamas in West Nusa Tenggara, Waingapu in East Nusa Tenggara, Wangi-Wangi in Southeast Sulawesi , Moswaren in West Papua, Long Apari in East Kalimantan, North Morotai in North Maluku, West Paniai District in Papua, and Jagoi Babang in West Kalimantan.

Until last July, Pertamina has added four more BBM Satu Price, namely in South Halmahera, North Maluku, Kabaruan Island and Karakelang Island, North Sulawesi, and West Seram, Maluku.

If the program is realized, fuel consumption in 3T areas will increase, Fuel Supply in target areas of BBM One Price program is estimated to reach 215 thousand kl in 2017 and become 580 thousand kl by 2019. To distribute BBM in BBM One Price Program, Pertamina is estimated to spend around Rp 2 trillion per year.

IN INDONESIA

Pertamina dan APBN Aman dari Gejolak Harga Minyak

Fluktuasi harga minyak mentah dunia belum mengganggu kinerja bisnis PT Pertamina. Proyek-proyek migas Pertamina yang sedang berjalan juga masih aman Meski demikian, gejolak harga minyak hingga di atas level US$ 50 per barel mesti diwaspadai karena bisa menggerus kemampuan investasi Pertamina dan mempersempit ruang fiskal APBN-P 2017.

Belakangan ini ada kekhawatiran harga minyak mentah kembali bergejolak setelah Organisasi Negara-negara Pengekspor Minyak (OPEC), Rusia, dan beberapa produsen utama lainnya memangkas produksi sekitar 1,8 juta barel per hari sejak awal 2017.

Kondisi itu turut memicu kenaikan harga minyak sekitar 15% dalam tIga bulan terakhir. Pemicu lain adalah berkurangnya utilisasi ladang-ladang minyak Amerika Serikat (AS). Harga minyak light sweet pengiriman November di level US$ 52,07 per barel, sedangkan minyak mentah brent pada kisaran US$ 58,19 per barel.

Dalam APBN-P 2017, asumsi harga minyak mentah nasional (Indonesia Crude Price/ ICP) dipatok US$ 48 per barel. Berdasarkan data Kementerian Eenergi dan Sumber Daya Mineral (ESDM), ICP rata-rata selama Januari hingga Agustus 2017 mencapai US$ 48,41 per barel. Direktur Keuangan Pertamina Arief Budiman mengungkapkan, harga minyak mentah yang relatif aman bagi Pertamina berada di level US$ 45-50 per barel.

“Soalnya, secara volume balance masih banyak di hilir dibandingkan di hulu migas. Belum lagi harga bahan bakar minyak (BBM) ritel yang masih mengikuti harga ketetapan pemerintah,” kata Arief.

Ditanya tentang kemungkinan kondisi keuangan Pertamina jika harga minyak melonjak di atas US$ 50 per barel dalam jangka waktu lama, Arief Budiman menjawab diplomatis, “Kalau di atas itu, namanya sanggup ya relatif. Kalau on going operations tentunya mungkin masih bisa meraih laba, namun akan menggerus kemampuan investasi.”

Arief menjelaskan, Pertamina membukukan pendapatan 19%, lebih tinggi pada semester I-2017 dibandingkan periode sama tahun lalu, yakni mencapai US$ 20,5 miliar. Namun, karena tergerus harga minyak mentah terus naik, sementara harga BBM ditahan tetap, laba Pertamina terkoreksi 24% menjadi US$ 1,4 miliar. Arief tidak merinci dampak penguatan harga minyak dunia terhadap investasi Pertamina.

“Kami harus membuat kalkulasi seberapa tinggi kenaikan harga minyak tersebut,” ujar dia.

Kendati demikian, menurut Arief Budiman, Pertamina sudah siap bila harga minyak mentah terus menguat.

“Kami sudah punya skenarionya. Ada beberapa langkah yang bisa dilakukan. Intinya masih banyak cara dan solusi, misalnya mengundang mitra,” tutur dia.

Secara terpisah, Direktur Perencanaan Investasi dan Manajemen Risiko Pertamina Gigih Prakoso mengakui, dari sisi finansial, Pertamina memiliki banyak keterbatasan. Di satu sisi, Pertamina harus memikirkan deviden untuk pemerintah. Di sisi lain, BUMN itu harus mampu menjaga kemampuan finansialnya. Itu sebabnya, Pertamina kini banyak menggalang kerja sama operasi dengan mitra strategis.

“Kami buka selebarnya joint venture atau kerja sama operasi. Kalau dulu semua sendiri. Saat ini, dengan memerhatikan kondisi dan tantangan yang ada, kami buka welcome bagi strategic partner.

Kami berkomitmen meningkatkan produksi migas dengan mengakuisisi ladang-ladang migas di luar negeri. Itu membutuhkan pendanaan dan mitra kredibel,” tandas dia.

Di pihak lain, Kepala Biro Komunikasi, Layanan Informasi Publik, dan Kerja Sama Kementerian ESDM Dadan Kusdiana mengemukakan, menguatnya harga minyak mentah dunia berkorelasi dengan penerimaan negara. Namun, Kementerian ESDM belum menghitung penerimaan negara dalam kaitannya dengan fluktuasi harga minyak selama tahun berjalan (year to date/ytd).

“Penguatan harga minyak akan mendongkrak penerimaan dari sektor migas. Tapi hal itu turut menaikkan besaran subsidi BBM. Intinya, penerimaan negara bukan pajak (PNBP) sektor migas, baik pusat maupun daerah, akan naik. Namun, besaran subsidi BBM juga ikut naik,” ujar dia.

Sementara itu, Dirjen Migas Kementerian ESDM Ego Syahrial menegaskan, pemerintah tidak menaikkan harga BBM jenis premium dan solar bersubsidi hingga akhir tahun ini meski harga minyak dunia menguat. Keputusan itu sepenuhnya mempertimbangkan kemampuan daya beli masyarakat.

“Belum ada perubahan, masih tetap sampai akhir tahun,” tandas dia.

Ego meyakini Pertamina masih mampu menanggung selisih harga keekonomian BBM bersubsidi seiring menguatnya harga minyak dunia. Namun, bukan berarti pemerintah tidak mempedulikan kondisi merugi yang dihadapi Pertamina dalam menyalurkan BBM bersubsidi. Menurut Ego, pemerintah juga memikirkan pengembangan investasi Pertamina, seperti di Blok Mahakam.

“Pemerintah harus melihat segala sesuatu secara komprehensif. Tidak melihat sesuatu dari sisi pemasaran BBM saja. Pemerintah memikirkan juga dari sisi korporasi. Pada saatnya pemerintah juga tidak tinggal diam,” tegas dia.

APBN Realistis

Anggota Komisi XI DPR Karya M Sarmuji mengungkapkan asumsi harga minyak mentah nasional (ICP) dalam APBN-P 2017 sebesar US$ 48 per barel masih cukup memadai dan tidak terlalu rendah di saat tren harga minyak yang sedang berangsur naik. Bahkan, sebelum menetapkan harga itu dalam pengesahan APBN-P 2017, DPR justru menilai angka itu masih terlalu tinggi.

“Jadi, sebelum menyetujui harga minyak US$ 48 per barel dalam APBN-P 2017, DPR dulu menganggapnya terlalu tinggi. Kami dari Komisi XI sempat khawatir rata-rata ICP akan bergerak di bawah itu,” tutur dia.

Sarmuji menjelaskan, ketika DPR dan pemerintah membahas dan menyetujui asumsi ICP dalam APBN-P 2017 sebesar US$ 48 per barel, ICP selama semester I-2017 rata-rata masih di level US$ 43 per barel. Kemudian, harga minyak dalam APBN-P disepakati US$ 48 per barel dengan mempertimbangkan harga minyak biasanya cenderung naik pada akhir tahun.

Tren kenaikan harga minyak mentah dunia akan terjadi dalam 1-2 bulan terakhir (Agustus-September). Itu terkait dengan siklus memasuki musim dingin di kawasan Amerika dan Eropa, sehingga membutuhkan pasokan BBM lebih banyak untuk menjaga udara tetap hangat, baik di rumah maupun di perkantoran.

Harga minyak Brent Laut Utara pada 26 September mencapai US$ 58,01 per barel untuk kontrak November 2017 dibandingkan awal Januari sekitar-US$ 56,82 per barel. Sedangkan harga minyak light sweet di pasar Nymex pada 26 September mencapai US$ 52,00 per barel dibandingkan awal Januari US$ 52, 33 per barel. Dengan asumsi-asumsi tersebut, Sarmuji yakin penerimaan minyak dan gas dalam APBN-P 2017 dan subsidi BBM relatif tidak banyak berubah.

“Kami yakin asumsi harga minyak US$ 50 per barel akan terpenuhi, sehingga asumsi penerimaan negara dan subsidi BBM pun tidak akan berubah,” tutur dia.

Moderat-Realistis

Senada dengan M Sarmuji, ekonom Indef Eko Listiyanto mengungkapkan, di saat tren harga minyak yang sedang naik akibat meningkatnya permintaan di Eropa dan Amerika, asumsi ICP dalam APBN-P 2017 sebesar US$ 48 per barel masih realistis. Karena itu, asumsi penerimaan migas dan subsidi BBM pun tidak perlu diubah. Dalam APBN-P 2017, subsidi ditetapkan Rp 168,87 triliun. Dari jumlah itu, Rp 50,2 triliun dialokasikan untuk BBM dan elpiji.

“Faktor-faktor musim dingin memang memicu kenaikan harga minyak di negara-negara Barat. Tapi karena poduksi dan pasokan yang melimpah dan pertumbuhan ekonomi dunia cenderung flat, harga minyak secara rata-rata tahun ini tidak akan naik signifikan. Jadi, asumsi harga minyak US$ 48 per barel dalam APBN-P 2017 masih moderet dan realistis," papar dia.

Eko Listiyanto memperkirakan ICP hingga akhir tahun ini tidak bergerak jauh dari kisaran saat ini US$ 50 per barel, walaupun minyak mentah jenis Brent sudah mendekati level US$ 60 per barel.

“Itu dengan asumsi tidak adanya gejolak geopolitik, baik di Timur Tengah sebagai pemasok utama minyak dunia maupun gangguan pasokan akibat gejolak di wilayah lain,” ucap dia.

Menurut dia, keputusan pemerintah dan DPR menaikkan asumsi ICP di APBN-2017 menjadi US$ 48 per barel dari asumsi APBN sebesar US$ 45 per barel juga tidak akan berpengaruh signifikan terhadap bisnis Pertamina.

“Pertamina tetap bisa membukukan keuntungan tidak jauh seperti yang diproyeksikan, walaupun harus mengimpor minyak mentah lebih banyak 50% dari kemampuan produknya untuk menjamin pasokan BBM di dalam negeri,” ujar dia.

Karena itu, Eko juga memperkirakan pengeluaran Pertamina untuk membiaya kegiatan public service obligation (PSO) BBM Satu Harga di daerah terdepan, tertinggal, dan terluar (3T) tidak akan banyak berubah dari asumsi awal. Program BBM Satu Harga juga tetap harus dijalankan dan dipertahankan untuk menjamin keadilan bagi masyarakat untuk mendapatkan harga BBM yang sama seperti di Pulau Jawa.

Direktur Utama Pertamina Elia Massa Manik baru-baru ini mengatakan, rata-rata harga minyak mentah selama semester I-2017 dibandingkan periode sama tahun silam naik 30% dari US$ 36,16 per barel menjadi US$ US$ 48,9 per barel. Namun, harga BBM bersubsidi dan penugasan ditahan tetap. Padahal, kata Elia, harga BBM saat ini dibentuk dengan patokan harga minyak mentah jauh di bawah harga saat ini.

“Tidak hanya itu, realisasi investasi yang dikucurkan Pertamina juga meningkat dari US$ 810 juta menjadi US$ 1,49 miliar,” tutur dia.

Direktur Keuangan Pertamina Arief Budiman beberapa waktu lalu menjelaskan, pendapatan perusahaan naik didorong kenaikan konsumsi BBM kenaikan harga BBM non-subsidi. Alhasil, dari sisi arus kas, keuangan Pertamina membaik.

“Posisi pada kuartal I, operating cash flow masih negatif, sekarang sudah positif. Tetapi tetap harus di-balance dengan pembayaran utang jangka pendek, sehingga kondisi sekarang bisa dipertahankan, bahkan membaik,” kata dia.

Data Pertamina menunjukkan, penjualan BBM Pertamina naik 4% pada semester I-2017 dibandingkan semester I-2016, yakni dari 31,47 juta kl menjadi 32,6 juta kl. Konsumsi Premium turun 34% dari 5,78 juta kl menjadi 3,82 juta kl, namun konsumsi bensin jenis Pertalite, Pertamax Turbo, dan Pertama naik 25,54% dari 9,75 juta kl menjadi 12,24 kl. Konsumsi solar bersubsidi juga naik dari 6,51 juta kl menjadi 6,8 juta ld dan konsumsi solar Dexlite meningkat dari 80 ribu kl menjadi 250 ribu kl.

Berdasarkan data Pertamina, penjualan produk non-BBM Pertamina meningkat selama semester I-2017, Sampai akhir Juni lalu, Pertamina membukukan penjualan gas minyak cair/LPG sebesar 6,23 juta MT, naik 6,3% dari 5,86 juta MT. Sedangkan penjualan produk petrokimia naik dari 1,31 juta kl menjadi 1,37 juta kl.

Kinerja hulu Pertamina juga lebih baik. Produksi migas sampai akhir Juni lalu mencapai 692 ribu barel setara minyak per hari (bsmph), naik 8% dari periode sama tahun lalu 640 ribu bsmph. Pertamina menargetkan produksi minyak sekitar 334 ribu bph dan gas sedikit lebih rendah 1% dari target,2.080 mmscfd.

Meski demikian, realisasi laba bersih tahun ini diproyeksikan tidak setinggi target karena harga BBM saat ini dibentuk dengan ICP US$ 30 per barel atau harga minyak mentah Brent US$ 40 per barel. Padahal, saat ini harga minyak mentah Brent sudah di atas US$ 50 per barel.

Berdasarkan rencana kerja anggaran perusahaan, laba bersih Pertamina pada 2017 ditargetkan US$ 3,04 miliar, namun realisasinya diperkirakan hanya sekitar US$ 2,3 miliar dengan asumsi harga minyak tidak berubah dan terjadi efisiensi.

Pertamina saat ini mendapat amanat untuk memberlakukan Program BBM satu Harga. Program ini mengacu ke Peraturan Menteri ESDM No 36 Tahun 2016 tentang Percepatan Pemberlakuan Satu Harga jenis BBM Tertentu (JBT) dan Jenis BBM Khusus Penugasan (JBKP).

Berdasarkan beleid ini, 148 kabupaten ditetapkan sebagai lokasi pendistribusian BBM dalam Program BBM Satu Harga secara bertahap pada periode 2017-2020. Di Indonesia saat ini terdapat sekitar 160 kabupaten/kota yang masuk kategori 3T mencakup sekitar 2 ribu kecamatan dan 21 ribu desa.

Sedangkan Program BBM Satu Harga yang dilaksanakan hingga 2019 hanya menjangkau 150 titik. Investasi penyaluran BBM yang dibutuhkan Pertamina berkisar Rp 2030 juta per titik. Dalam Roadmap BBM Satu Harga, pemerintah menargetkan pengoperasian 150 lembaga penyalur hingga tahun 2019.

Rincinya, sebanyak 54 titik akan diselesaikan pada 2017, selanjutnya 50 titik pada 2018, dan 46 titik pada 2019. Dua badan usaha yang ditugaskan untuk melaksanakan program ini adalah Pertamina dan PT AKR Corporindo.

Selama semester I-2017, Pertamina telah merealisasikan Program BBM Satu Harga di 21 titik dari target 54 titik tahun ini. Sebanyak 21 titik itu terdiri atas delapan titik yang merupakan bagian Program Papua Satu Harga, satu titik di Krayan, Kalimantan Utara, serta 12 titik dari 54 titik yang menjadi target pelaksanaan program Indonesia Satu Harga tahun ini.

Ke-12 tilik ini tersebar di Pulau Batu di Sumatera Utara, Siberut Tengah di Sumatera Barat, Kepulauan Karimun di Jawa Tengah, Pulau Raas di Jawa Timur, Tanjung Pengamas di Nusa Tenggara Barat, Waingapu di Nusa Tenggara Timur, Wangi-Wangi di Sulawesi Tenggara, Moswaren di Papua Barat, Long Apari di Kalimantan Timur, Morotai Utara di Maluku Utara, Distrik Paniai Barat di Papua, serta Jagoi Babang di Kalimantan Barat.

Hingga Juli lalu, Pertamina menambah empat lagi lembaga penyalur BBM Satu Harga, yakni di Halmahera Selatan, Maluku Utara, Pulau Kabaruan dan Pulau Karakelang, di Sulawesi Utara, serta Seram Bagian Barat, Maluku.

Jika program ini terealisasi, konsumsi BBM di wilayah-wilayah 3T akan meningkat, Penyaluran BBM di daerah-daerah target program BBM Satu Harga diestimasikan mencapai 215 ribu kl pada 2017 dan menjadi 580 ribu kl pada 2019. Untuk menyalurkan BBM dalam Program BBM Satu Harga, Pertamina diperkirakan mengeluarkan biaya distribusi sekitar Rp 2 triliun per tahun.

Investor Daily, Page-1, Thursday, Sept 28, 2017

No comments:

Post a Comment