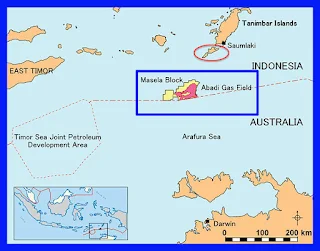

It took a long time to develop Abadi Field, Masela Block since its cooperation contract was signed in 1998. In 2008, Masela Limited as operator has submitted the development plan (PoD) gas field in the Arafura Sea.

However, after 9 years later, no production facilities have been seen. Because the development of Abadi Field several times must be problematic. First, about local community bills on project participation rights. Second, about

polemic utilization of gas. Third, a development scheme that makes two ministers argue publicly.

Due to these problems, President Joko Widodo intervened by changing the scheme of field development from construction of a floating liquefied natural gas (FLNG) refinery proposed by lnpex to be a land-based LNG plant (OLNG). Following the March 2016 decision, Inpex and its partner Shell again counted on the project economy and created its new POD.

The lnpex, which holds a 65% stake in participation, suggests a few things for the project to work on economically even if the project is changing. The proposal is one of them is the addition of contract time. For operations to operate economically, the Masela-lnpex Block management contract period needs to be extended for more than 30 years.

Masela Block - Owner By Inpex Japan

The reason is, for 30 years time has been wasted to conduct a review of the LNG plant construction scheme which ultimately was not approved by the government. Therefore, it takes additional time to sell all gas from the refinery with a production capacity of LNG 9.5 million tons per year (mtpa) plus 150 MMscfd of piped gas.

Minister of Energy and Mineral Resources lgnasius Jonan has several times flown to Japan, visiting directly to the head office lnpex. After his return from Japan in May, it is certain that a pre-FEED review will only be done on a scheme of 9.5 mtpa plus 150 MMscfd of pipe gas instead of 7.5 mtpa LNG and 474 MMscfd of pipe gas.

Also since then, pre-FEED has not started yet because there is still a desire for the government to lnpex to examine other schemes with larger pipeline gas volumes. Then, even then, the budget for pre-FEED has not been approved by SKK Migas.

EXTENSION

On the occasion of the next visit, on 17 October Jonan gave the green light an extension of the cooperation contract to lnpex in the management of the Masela Block. Referring to government targets, the development of Abadi Field, Masela Block is targeted to deliver final investment decision / FID in 2019 and begin to generate its first gas in 2026 or just two years before the contract expires in 2028.

In addition to the extension of the contract, Jonan at the meeting granted a replacement contract period that was lost for 7 years according to lnpex's proposal. As stipulated in Government Regulation No. 35/2004 on Upstream Oil and Gas Business Activities, the contract can be extended for a maximum period of 20 years by considering state consent. As for, contract renewal can only be delivered in the 20th year of contract age or 2018 for the Masela Block.

Meanwhile, the government can set a contract extension more quickly if the contractor is tied to the distribution of natural gas. Meanwhile, in the case of Masela Block, no contract has been signed because investors have not yet know the selling price of gas which will be produced from Abadi Field.

Not yet explained in detail the reason Minister Jonan grant the extension of the Masela Block contract. Obviously, things such as reserve potential, market potential as well as technical and economic feasibility should be taken into consideration. Head of Program and Communication Division of SKK Migas Wisnu Prabawa Taher who also flew to Tokyo, said that lnpex is currently doing

procurement for pre-FEED workmanship.

The authorization for expenditure (AFE) for pre-FEED has been approved by SKK Migas so that lnpex can start the pre-FEED stages. After pre-FEED, FEED will be done to do more detail calculation because the result of FEED will be used as the basis for the preparation of new POD. APE pre-FEED has been approved, now in the procurement process, "he said

Separately, Vice President of Corporate Services of lnpex Corporation Nico Muhyiddin said that it was still discussing with SKK Migas on the pre-FEED project package tender planning.

"Inpex remains committed to the Masela Block and continuously discusses it," he said.

However, the signal from the Indonesian government to grant a contract extension to Inpex in Masela Block is to provide certainty of investment to the Japanese oil corporation. Investment certainty is expected to move the giant corporation from the Land of the Rising Sun to immediately execute Abadi Field, Masela Block.

IN INDONESIA

Jalan Berliku Blok Masela

Butuh waktu lama untuk bisa mengembangkan Lapangan Abadi, Blok Masela sejak kontrak kerja samanya ditandatangani pada 1998. Pada 2008, lnpex Masela Limited sebagai operator telah menyampaikan rencana pengembangan (PoD) lapangan gas di Laut Arafura itu.

Namun, selang 9 tahun kemudian, belum terlihat fasilitas produksi yang beroperasi. Pasalnya, pengembangan Lapangan Abadi beberapa kali harus bermasalah. Pertama, tentang tagihan masyarakat daerah tentang hak partisipasi proyek. Kedua, tentang polemik pemanfaatan gas. Ketiga, skema pengembangan yang membuat dua menteri adu pendapat di muka publik.

Akibat masalah-masalah itu, Presiden Joko Widodo turun tangan dengan mengubah skema pengembangan lapangan dari pembangunan kilang gas alam cair terapung (floating liquefied natural gas/FLNG) yang diusulkan lnpex menjadi kilang LNG darat (OLNG). Setelah keputusan yang dibuat Maret 2016 itu, lnpex bersama mitranya Shell kembali berhitung tentang keekonomian proyek dan membuat POD barunya.

lnpex yang menguasai saham partisipasi sebesar 65%, mengusulkan beberapa hal agar proyek bisa dijalankan sesuai keekonomian kendati proyek mengalami perubahan. Usulannya salah satunya yakni penambahan waktu kontrak. Agar operasi berjalan sesuai keekonomian, masa kontrak pengelolaan Blok Masela-lnpex perlu diperpanjang selama lebih dari 30 tahun.

Alasannya, selama 30 tahun saja waktu telah terbuang untuk melakukan kajian skema pembangunan kilang LNG yang pada akhirnya tidak disetujui pemerintah. Oleh karena itu, diperlukan penambahan waktu untuk menjual seluruh gas dari kilang berkapasitas produksi LNG 9,5 juta ton per tahun (mtpa) ditambah 150 MMscfd gas pipa.

Menteri ESDM lgnasius Jonan telah beberapa kali terbang ke Jepang, berkunjung langsung ke kantor pusat lnpex. Setelah kepulangannya dari Jepang pada Mei, sudah ada kepastian bahwa kajian pra pendefinisian proyek (pre-FEED) hanya akan dilakukan pada satu skema yakni 9,5 mtpa ditambah 150 MMscfd gas pipa bukan 7,5 mtpa LNG dan 474 MMscfd gas pipa.

Pun sejak saat itu, pre-FEED belum dimulai karena masih ada keinginan pemerintah agar lnpex mengkaji skema lain dengan volume gas pipa yang lebih besar. Lalu, ketika itu pun, anggaran untuk melakukan pre-FEED belum mendapat persetujuan dari SKK Migas.

PERPANJANGAN

Pada kesempatan kunjungan berikutnya, yakni pada 17 Oktober Jonan memberikan lampu hijau perpanjangan kontrak kerja sama kepada lnpex dalam pengelolaan Blok Masela. Mengacu pada target-target pemerintah, pengembangan Lapangan Abadi, Blok Masela ditargetkan bisa menyampaikan final investment decision/FID pada 2019 dan mulai menghasilkan gas perdananya pada 2026 atau hanya dua tahun sebelum kontrak berakhir pada 2028.

Selain perpanjangan kontrak, Jonan dalam pertemuan itu mengabulkan penggantian masa kontrak yang hilang selama 7 tahun sesuai usulan lnpex. Seperti diatur dalam Peraturan Pemerintah Nomor 35/2004 tentang Kegiatan Usaha Hulu Minyak dan Gas Bumi, kontrak bisa diperpanjang paling lama 20 tahun dengan mempertimbangkan keutungan negara. Adapun, perpanjangan kontrak baru bisa disampaikan pada tahun ke-20 umur kontrak atau 2018 bagi Blok Masela.

Adapun, pemerintah bisa menetapkan perpanjangan kontrak lebih cepat bila kontraktor terikat penyaluran gas bumi. Sementara, pada kasus Blok Masela, belum ada kontrak yang diteken karena investor pun belum mengetahui harga jual gas yang nantinya dihasilkan dari Lapangan Abadi.

Belum dijelaskan secara detail alasan Menteri Jonan mengabulkan perpanjangan kontrak Blok Masela. Pastinya, hal-hal seperti potensi cadangan, potensi pasar juga kelayakan teknis serta ekonomis harus menjadi pertimbangannya. Kepala Divisi Program dan Komunikasi SKK Migas Wisnu Prabawa Taher yang turut terbang ke Tokyo, mengatakan bahwa saat ini lnpex sedang melakukan pengadaan untuk pengerjaan pre-FEED.

Anggaran (authorization for expenditure/AFE) untuk melakukan pre-FEED telah disetujui SKK Migas sehingga lnpex bisa memulai tahapan pre-FEED. Setelah pre-FEED, nantinya akan dilakukan FEED untuk melakukan perhitungan lebih detail karena hasil FEED akan dijadikan dasar penyusunan POD yang baru. APE pre-FEED sudah disetujui, sekarang dalam proses pengadaan,” katanya

Secara terpisah, Vice President Corporate Service lnpex Corporation Nico Muhyiddin mengatakan bahwa pihaknya masih melakukan diskusi dengan SKK Migas tentang perencanaan tender paket pengerjaan pre-FEED.

“lnpex tetap berkomitmen dengan Blok Masela dan kontinu mendiskusikannya,” katanya.

Namun, sinyal pemerintah Indonesia memberikan perpanjangan kontrak kepada lnpex di Blok Masela tidak lain untuk memberikan kepastian investasi kepada korporasi minyak asal Jepang tersebut. Kepastian investasi itu diharapkan mampu menggerakkan korporasi raksasa dari Negeri Matahari Terbit itu untuk segera mengeksekusi Lapangan Abadi, Blok Masela.

Bisnis Indonesia, Page-30, Thursday, October 19, 2017