PT Pertamina (Persero) and PT Trans Pacific Petrochemical Indotama (TPPI) export Paraxylene petrochemical products totaling 10,000 metric tons (MT) to China, to meet market demand in the Asia Pacific region. The initial export of paraxylene products is carried out in line with the production rate of the TPPI refinery which now reaches 67 tons per hour.

PT TPPI Tuban General Manager Sugeng Hermanto said, with product operations reaching 67 tons per hour, it could produce 70 tons of paraxylene per hour. So, in a month, this paraxylene production reaches 50,000 metric tons.

PT Trans Pacific Petrochemical Indotama (TPPI)

"Therefore Pertamina distributes it to domestic and overseas," Sugeng said in his official statement on Monday (4/12)

He said, the production of paraxylene has exceeded demand in the domestic market, so excess production can be exported abroad. Manager of Aromatic Olefin Pertamina Darius Darwis added, paraxylene exports will be utilized to meet regional market needs, especially in China. Going forward, the company will continue to develop petrochemical exports.

"Pertamina and TPPI will carry out tenders to find the best buyers, with volumes according to TPPI's production plan," Darius explained.

Paraxylene is the main raw material for producing Purified Terephthalic Acid (PTA). Paraxylene is the product of petrochemical refineries produced from condensate or naptha. The results of paraxylene are mostly in the form of PTA which is an important component in the textile industry.

In addition, paraxylene can also be processed into PET as the main component of raw materials for food and beverage packaging because of its non-toxic nature. Paraxylene also has derivative products that are closely related to daily life such as cellphones, dashboards on vehicles, and so on.

"We hope that, in accordance with the government's recommendations, we optimize domestic production. Instead of increasing imports, we better increase exports so that it will increase foreign exchange, of course Pertamina's profits will also be higher than before, "Darius said.

Pertamina is committed to strengthening its petrochemical business. For this reason, the oil and gas SOE has signed a frame work agreement with Taiwan Petroleum Corporation (CPC) to build a petrochemical complex worth US $ 6.49 billion. The facility was built, namely a naphta cracker factory and a global scale petrochemical downstream sector development unit in Indonesia.

CPC Taiwan

The project will be carried out under a joint venture scheme between Pertamina, CPC Taiwan, and several other potential downstream partners. The naphta cracker plant is expected to produce at least 1 million tons of ethylene per year. In addition, both of them will also build downstream units that will produce other refinery derivative products to meet industrial needs in Indonesia.

Previously, Megaproject Processing and Petrochemical Director Ignasius Tallulembang explained that his party had already had initial discussions with CPC. In the first stage, it will prepare the land which is the location of this petrochemical project. So far, there are three location options, which are possible options near the Balongan Refinery.

"After the land, our parallel will do the FS (feasibility study) to configure the petrochemical refinery, any products, with partners," he said.

Furthermore, it will also form a joint venture with CPC. However, his side still has to discuss this with the CPC, including the matter of the amount of Pertamina's share ownership. It hopes to become a majority shareholder.

"Because we are in the country, the market is in us, so we are expected to have a bigger share," Tallulembang said.

Rosneft Oil Company Russia

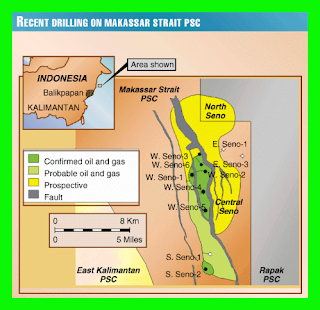

In addition, the company's two new refinery projects will also be equipped with processing petrochemical products, namely Tuban Refinery and Bontang Refinery. The Tuban refinery that the company works with Rosneft Oil Company is targeted to be completed in 2024. This refinery will produce gasoline (gasoline) products of 80 thousand barrels per day (bpd), diesel fuel 90 thousand bpd, and avtur of 26 thousand bpd.

Rosneft Refinery in Tuban, East Java-Indonesia

Not only that, Tuban Refinery will also produce new petrochemical products. The details of this product are 1.3 million tons of polypropylene per year, polyethylene 0.65 million tons per year, styrene 0.5 million tons per year, and paraxylene 1.3 million tons per year.

Furthermore, the Bontang Refinery is planned to have a capacity of 300 thousand bpd and is targeted to start operations in 2025. Unfortunately, Pertamina has not specified what kind of products the new refinery will produce. The reason is that Pertamina is still in the stage of discussion with partners regarding the establishment of joint ventures.

the Overseas Oil and Gas LLC (OOG)

The company that the company cooperates with is the Overseas Oil and Gas LLC (OOG) and Cosmo Oil International Pte Ltd (COI). Previously, Maritime Coordinating Minister Luhut Binsar Pandjaitan reminded Pertamina to seriously work on fuel and petrochemical refinery projects. The reason is that President Joko Widoro complained that there had been no construction of refineries running during his four years in office.

"I ask not to be postponed again, because I have been pushing for three years in petrochemicals from Taipei, not immediately," he said.

IN INDONESIAN

Pertamina-TPPI Ekspor Perdana Paraxylene

PT Pertamina (Persero) bersama PT Trans Pacific Petrochemical Indotama (TPPI) mengekspor produk petrokimia Paraxylene sebanyak 10 ribu metrik ton (MT) ke Tiongkok, untuk memenuhi permintaan pasar di kawasan Asia Pasifik. Ekspor perdana produk paraxylene ini dilakukan seiring dengan tingkat produksi kilang TPPI yang kini mencapai 67 ton per jam.

General Manager PT TPPI Tuban Sugeng Hermanto mengatakan, dengan operasional produk mencapai 67 ton per jam, pihaknya dapat menghasilkan paraxylene sebanyak 70 ton tiap jam. Sehingga, dalam sebulan, produksi paraxylene ini mencapai 50 ribu metrik ton.

“Oleh karena itu Pertamina menyalurkan ke domestik maupun luar negeri,” ujar Sugeng dalam keterangan resminya, Senin (4/12)

Dia mengatakan, produksi paraxylene ini sudah melampaui kebutuhan di pasar domestik, sehingga kelebihan produksi dapat diekspor ke luar negeri. ManagerArornatic Olefin Pertamina Darius Darwis menambahkan, ekspor paraxylene ini akan dimanfaatkan untuk memenuhi kebutuhan pasar regional khususnya di Tiongkok. Ke depan, perseroan akan terus mengembangkan ekspor petrokimia.

“Pertamina dan TPPI akan melaksanakan tender untuk mencari pembeli terbaik, dengan volume sesuai rencana produksi TPPI,” jelas Darius.

Paraxylene adalah bahan baku utama untuk memproduksi purified terephthalic acid (PTA). Paraxylene merupakan hasil produksi kilang petrokimia yang diproduksi dari, bahan kondensat atau naptha. Hasil paraxylene sebagian besar berupa PTA yang menjadi komponen penting dalam industri tekstil.

Selain itu, paraxylene juga dapat diproses menjadi PET sebagai komponen utama bahan baku kemasan makanan dan minuman karena sifatnya tidak beracun. Paraxylene juga memiliki produk turunan yang berkaitan erat dengan kehidupan sehari-hari seperti tempat (casing) telepon genggam, dashboard pada kendaraan, dan sebagainya.

“Kami berharap, sesuai dengan anjuran pemerintah, kita mengoptimalkan hasil produksi dalam negeri. Daripada memperbanyak impor, kita lebih baik memperbanyak ekspor jadi akan menambah devisa negara tentunya keuntungan Pertamina juga akan lebih banyak dari sebelumnya,” tutur Darius.

Pertamina berkomitmen memperkuat bisnis petrokimianya. Untuk itu, BUMN migas ini telah menandatangani frame work agreement dengan China Petroleum Corporation (CPC) Taiwan membangun komplek petrokimia senilai US$ 6,49 miliar. Fasilitas yang dibangun yakni pabrik naphta cracker dan unit pengembangan sektor hilir petrokimia berskala global di Indonesia.

Proyek akan dikerjakan dengan skema joint venture antara Pertamina, CPC Taiwan, dan beberapa mitra hilir potensial lainnya. Pabrik naphta cracker diharapkan akan memproduksi paling sedikit 1 juta ton ethylene per tahun. Selain itu, keduanya juga akan membangun unit hilir yang akan memproduksi produk turunan kilang lainnya untuk memenuhi kebutuhan industri di Indonesia.

Sebelumnya, Direktur Megaproyek Pengolahan dan Petrokimia Ignasius Tallulembang menjelaskan, pihaknya sudah ada diskusi awal dengan CPC. Pada tahap pertama, pihaknya akan menyiapkan lahan yang menjadi lokasi proyek petrokimia ini. Sejauh ini, ada tiga opsi lokasi, di mana opsi yang memungkinkan yakni di dekat Kilang Balongan.

“Setelah lahan, paralel kami akan lakukan FS (feasibility study/kajian kelayakan) untuk membuat konfigurasi kilang petrokimianya, produk-produknya apa saja, bersama partner,” tutur dia.

Selanjutnya, pihaknya juga akan membentuk perusahaan patungan dengan CPC. Namun, pihaknya masih harus mendiskusikan hal ini bersama CPC, termasuk soal besaran kepemilikan saham Pertamina. Pihaknya berharap bisa menjadi pemegang saham mayoritas.

“Karena kita kan di dalam negeri, pasarnya di kita, jadi diharapkan kami yang lebih besar share-nya,” ujar Tallulembang.

Selain itu, dua proyek pembangunan kilang baru perseroan juga akan dilengkapi dengan pengolahan produk petrokimia, yakni Kilang Tuban dan Kilang Bontang. Kilang Tuban yang dikerjakan perseroan bersama Rosneft Oil Company ditargetkan rampung pada 2024. Kilang ini akan menghasilkan produk bensin (gasoline) sebesar 80 ribu barel per hari (bph) , solar 90 ribu bph, dan avtur 26 ribu bph.

Tidak hanya itu, Kilang Tuban juga akan memproduksi produk-produk baru petrokimia. Rincian produk ini adalah polipropilen 1,3 juta ton per tahun, polietilen 0,65 juta ton per tahun, stirena 0,5 juta ton per tahun, dan paraksilen 1,3 juta ton per tahun.

Selanjutnya, Kilang Bontang direncanakan memiliki kapasitas 300 ribu bph dan ditargetkan mulai operasi pada 2025. Sayangnya, Pertamina belum merinci apa saja jenis produk yang akan dihasilkan kilang baru ini. Pasalnya, Pertamina masih dalam tahap diskusi dengan mitra terkait pembentukan perusahaan patungan.

Perusahaan yang digandeng perseroan di proyek ini adalah Overseas Oil and Gas LLC (OOG) dan Cosmo Oil International Pte Ltd (COI). Sebelumnya, Menteri Koordinator Kemaritiman Luhut Binsar Pandjaitan mengingatkan Pertamina untuk serius mengerjakan proyek kilang BBM dan petrokimia. Pasalnya, Presiden joko Widoro mengeluhkan bahwa tidak ada pembangunan kilang yang berjalan selama menjabat dalam empat tahun ini.

“Saya minta jangan ditunda lagi, karena saya sudah tiga tahun mendorong petrokimia dari Taipei tidak segera di,ulai,” kata dia.

Investor Daily, Page-1, Wednesday, Dec 5, 2018