PT Pupuk Indonesia (Persero) is still reviewing the utilization of gas from the Tangguh Train III refinery which will be used as raw material for fertilizer and petrochemical factories in Bintuni Bay, West Papua.

|

| Tangguh Train III |

Head of Communications for the Indonesian Fertilizer Corporation, Wijaya Laksana, said that the plan to build a fertilizer factory in Bintuni Bay is still in the discussion stage. According to him, the current supply of urea-type fertilizer is already in excess so the construction of a new fertilizer factory is not appropriate.

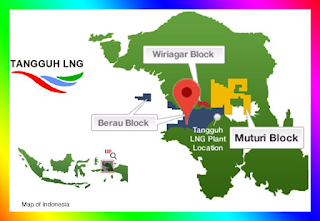

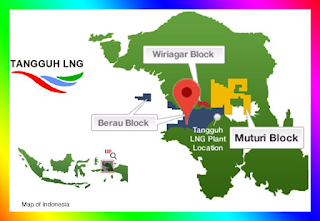

To utilize gas from the Tangguh Train III refinery in West Papua, which is operated by British Petroleum (BP), the government supports businesses to build a fertilizer and petrochemical factory in Bintuni Bay.

According to him, PT Pupuk Indonesia is still discussing with the Ministry of State-Owned Enterprises (BUMN) and the Ministry of Industry regarding gas-based industrial projects other than fertilizers such as petrochemicals. According to him, the plan to build a gas-based factory will still be carried out. However, his party is still waiting for the results of the study conducted regarding what factory will be built to utilize gas from Tangguh.

He explained that the construction of a fertilizer factory requires an investment of Rp. 8 trillion, as was done at the Kaltim-5 Bontang Factory, East Kalimantan. The factory has a production capacity of 850,000 tons of ammonia and 1.15 million tons of urea per year.

The development of the petrochemical and fertilizer industry in Bintuni Bay will use an area of 2,344 hectares. The existence of the industry is expected to get an investment of up to US$ 10 billion. Wijaya said the gas supply for the petrochemical plant in Bintuni Bay can come from any oil and gas field. However, the gas price that can be received by petrochemical plants is around US$ 3 per MMBtu. He said that his party did not know about the plan to exchange gas allocations or swaps from Tangguh Train III to the Kasuri Block.

According to him, there has been no formal offer related to the gas swap. Head of Spokesperson for the Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) Taslim Z. Yunus said the gas swap option was carried out to accelerate gas development from the Kasuri Block operated by Genting Oil Kasuri Pte. Ltd.

|

| The Kasuri Block |

The Kasuri Block will start producing gas after three years of the Plan of Development/POD phase I being approved. Vice President Jusuf Kalla asked for efficiency efforts from all lines to realize the decline in industrial gas prices which is expected to take place starting December 2016.

According to him, President Joko Widodo's instructions to conduct a study on the reduction in gas prices within two months must be immediately realized through efficiency on all fronts by related parties. It certainly aims to increase the competitiveness of the national industry with other countries. The way, starting from the efficiency of the production process in the country, the distribution process, to the policy of traders who are advised not to be too many.

The statement was made as a follow-up to the President's instruction to push the price of industrial gas to no more than US$6 per MMBtu. As stated in Presidential Regulation Number 40 of 2016 concerning Natural Gas Price Determination, as many as seven industries are entitled to cheap gas prices, namely fertilizers, petrochemicals, oleochemicals, steel, ceramics, glass, and gloves.

Bisnis Indonesia, Page-30, Tuesday, Oct 25, 2016