Saturday, June 30, 2018

Project Tangguh Train 3 Continues to Target

Wednesday, May 9, 2018

Performance of Oil and Gas giant is Shiny

Wednesday, November 23, 2016

Finally, BP released the Sanga Sanga oil block

Thursday, October 27, 2016

Regulatory Reform Needs, Accelerate Oil and Gas Infrastructure

According to an economic observer from Airlangga University, Dr. Nafik HR, the current government must reform its economic policies which are still using a neoliberal paradigm by replacing them with economic policies that are in favor of the people's and national interests and of course constitutional.

Let's just say frankly that the abundant natural wealth so far has been managed by foreign parties, and it is very profitable for them. Therefore, this is what must be taken over to become fully national control.

Then protect the control and development as well as the use of alternative energy such as geothermal, hydropower, solar power, and others that are still very potent. Later it can be managed by state companies such as Pertamina or other national private companies, to help the Indonesian government reduce national imports and in order to increase the production of domestic energy resources and consumption.

Of course, to manage this abundant oil and gas sector and alternative energy, Pertamina needs full support, especially regulations from the government, because so far it turns out that, in terms of managing oil and gas resources, Pertamina is not given the main authority and especially when compared to foreign companies such as Petronas (Malaysia). ), Shell (Netherlands), Chevron (USA), Total (France), ConocoPhillips (USA), ExxonMobil (USA), CNOOC (China), ENI (Italy), KUFPEC (Kuwait), British Petroleum (UK), and so. Just look at how the Regulation of the Minister of Energy and Mineral Resources Number 15 of 2015 is actually very detrimental to Pertamina.

So that whenever this country is declared to exist, the hope that this nation will have energy independence will definitely not be realized. The government's mistakes in the past in managing our natural wealth should be used as a lesson so that in the future it will be returned again for the prosperity of the people.

A legal observer from the University of Muhammadiyah Surabaya (UMS) Umar Sholahudin assessed that regulation is still seen as one of the homework that must be done in national development planning. Umar admits that there are many overlapping, multi-interpreted, disharmony, or inconsistent laws and regulations, all of which actually disturb the investment climate or economic growth, for example, there are regulations governing the same sector but with different mechanisms.

Not a single state institution knows the exact number of laws and regulations issued by the central government and local governments. It means that the government, and the House of Representatives (DPR), are not serious about reforming regulations. The Minister of Energy and Mineral Resources Regulation No. 15/2015 on the management of Oil and Gas working areas whose contract period will expire is very clearly detrimental to Pertamina as a state company.

This ministerial regulation considers Pertamina to be the same as other oil and gas companies when it wants to take over the management of the oil and gas Working Area (WK) which will expire. The full authority of the Ministry of Energy and Mineral Resources to choose/determine which companies will be granted oil and gas management concessions will undermine Pertamina's important role.

In fact, the ministerial regulation has clearly stated that the government does not at all give guarantees to Pertamina to control the concession of the oil and gas working area which will expire, even though there has been a Government Regulation of the Republic of Indonesia Number 35 of 2004 which favors the national interest in terms of controlling national oil and gas resources.

In short, Pertamina must be more empowered, play a dynamic role in obtaining full concessions or the holder of all concessions for all projects at the forefront of the oil and gas and energy sectors so that they have a major impact on Pertamina's progress, and can choose partners if necessary.

In the 2015-2019 National Medium-Term Development Plan (RPJMN) stipulated by Presidential Regulation No. 2 of 2015, energy security is described as to the extent to which energy can be provided in a timely manner and with guaranteed availability, affordable prices, and acceptable quality.

The indicators are the amount of energy, the availability of infrastructure, the price of energy, the quality of energy, as well as the energy portfolio or mix. Energy security also has an element of sustainability so its management must pay attention to the carrying capacity of the environment. According to Dwi Sutjipto, the government is serious about realizing energy independence, as evidenced by the acceleration in the development of energy infrastructure projects.

Various regulations stimulate the development of energy sources at a time when there is a lack of discovery of national oil and gas reserves and fluctuations in world oil prices. The acceleration of energy infrastructure is the main key to creating energy independence now and in the future.

According to Dwi Sutjipto, Pertamina has become the backbone of national energy fulfillment. Not only contributing to the production of energy sources in the form of oil and natural gas which contribute as foreign exchange for the country, Pertamina also has the task of providing and distributing the ever-increasing supply of fuel oil (BBM) and gas.

Pertamina's Vice President of Corporate Communication Wianda Pusponegoro explained as a national oil company (NOC) Pertamina has the responsibility to ensure that energy supply is always in a safe condition for national energy security, under any circumstances. In order for this to be realized, Pertamina has launched 5 strategic priorities, namely, the development of the upstream sector, efficiency in all lines, increasing the capacity of refineries and petrochemicals, developing infrastructure and marketing, and improving the financial structure.

|

| Wianda Puponegoro |

According to Wianda, the five strategic priorities are implemented through various innovations. Pertamina's innovations include ensuring that all projects to support energy independence continue. Such as refinery development projects and the construction of new refineries, as well as the development of marketing infrastructure continues according to the established roadmap. International business development is a critical factor for Pertamina to develop into an international class company and to support the realization of national energy security.

Bhirawa, Page-4, Wednesday, Oct 26, 2016

Tuesday, October 25, 2016

The utilization of Tangguh Gas is still being studied

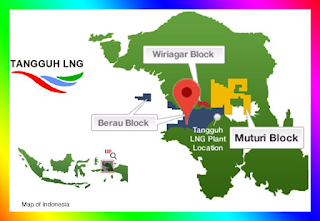

PT Pupuk Indonesia (Persero) is still reviewing the utilization of gas from the Tangguh Train III refinery which will be used as raw material for fertilizer and petrochemical factories in Bintuni Bay, West Papua.

|

| Tangguh Train III |

Head of Communications for the Indonesian Fertilizer Corporation, Wijaya Laksana, said that the plan to build a fertilizer factory in Bintuni Bay is still in the discussion stage. According to him, the current supply of urea-type fertilizer is already in excess so the construction of a new fertilizer factory is not appropriate.

|

| BP |

To utilize gas from the Tangguh Train III refinery in West Papua, which is operated by British Petroleum (BP), the government supports businesses to build a fertilizer and petrochemical factory in Bintuni Bay.

According to him, PT Pupuk Indonesia is still discussing with the Ministry of State-Owned Enterprises (BUMN) and the Ministry of Industry regarding gas-based industrial projects other than fertilizers such as petrochemicals. According to him, the plan to build a gas-based factory will still be carried out. However, his party is still waiting for the results of the study conducted regarding what factory will be built to utilize gas from Tangguh.

He explained that the construction of a fertilizer factory requires an investment of Rp. 8 trillion, as was done at the Kaltim-5 Bontang Factory, East Kalimantan. The factory has a production capacity of 850,000 tons of ammonia and 1.15 million tons of urea per year.

The development of the petrochemical and fertilizer industry in Bintuni Bay will use an area of 2,344 hectares. The existence of the industry is expected to get an investment of up to US$ 10 billion. Wijaya said the gas supply for the petrochemical plant in Bintuni Bay can come from any oil and gas field. However, the gas price that can be received by petrochemical plants is around US$ 3 per MMBtu. He said that his party did not know about the plan to exchange gas allocations or swaps from Tangguh Train III to the Kasuri Block.

According to him, there has been no formal offer related to the gas swap. Head of Spokesperson for the Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) Taslim Z. Yunus said the gas swap option was carried out to accelerate gas development from the Kasuri Block operated by Genting Oil Kasuri Pte. Ltd.

|

| The Kasuri Block |

The Kasuri Block will start producing gas after three years of the Plan of Development/POD phase I being approved. Vice President Jusuf Kalla asked for efficiency efforts from all lines to realize the decline in industrial gas prices which is expected to take place starting December 2016.

According to him, President Joko Widodo's instructions to conduct a study on the reduction in gas prices within two months must be immediately realized through efficiency on all fronts by related parties. It certainly aims to increase the competitiveness of the national industry with other countries. The way, starting from the efficiency of the production process in the country, the distribution process, to the policy of traders who are advised not to be too many.

The statement was made as a follow-up to the President's instruction to push the price of industrial gas to no more than US$6 per MMBtu. As stated in Presidential Regulation Number 40 of 2016 concerning Natural Gas Price Determination, as many as seven industries are entitled to cheap gas prices, namely fertilizers, petrochemicals, oleochemicals, steel, ceramics, glass, and gloves.

Bisnis Indonesia, Page-30, Tuesday, Oct 25, 2016